Partner with Wedge Industries Limited in India – Investors & Financers Welcome

At Wedge India, we are building the future of smart insulation, EV battery protection, refractory systems, and energy-efficient prefab modular construction. We invite investors and financers to become our growth partners in one of the most profitable and fast-growing markets in India and globally.

We operate in a high-demand sales environment powered by continuous innovation, dynamic technologies, and robust operating systems, delivering premium quality standards to industrial and consumer clients.

Why Invest in Wedge Industries Limited in India?

-

Assured Returns – Minimum 24% annual returns on investment (subject to financial structure, terms & conditions).

-

Positioned in fast-growing markets (EV batteries, cold chain, prefab housing, green construction).

-

Strong brand reputation in insulation and prefabricated construction.

-

Clear scaling strategy with focus on India’s infrastructure boom and global demand.

-

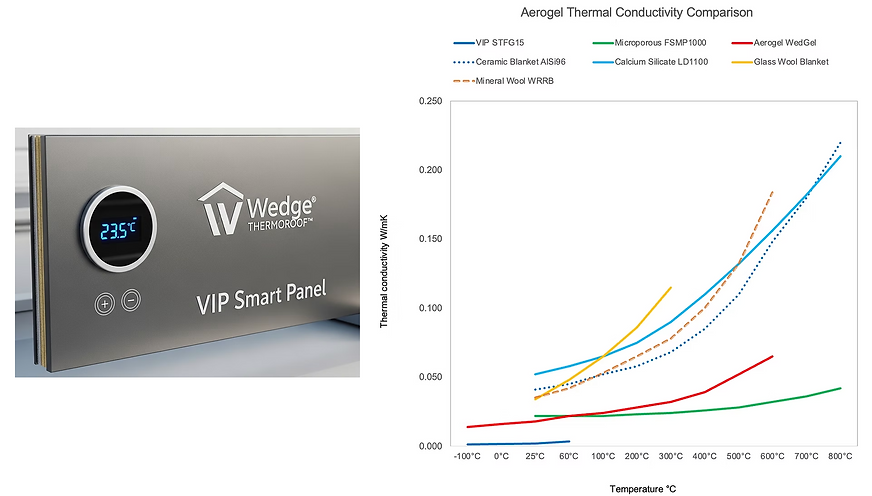

High-margin products with technology-driven differentiation (Aerogel, VIPs, PIR panels).

-

Transparent governance, professional management, and global leadership experience.

-

High-Growth Sectors – EV battery insulation, smart insulation systems, refractory products, and modular prefab construction.

-

Strong Market Demand – Insulation and prefab are among the most profitable and fast-growing industries worldwide.

-

Technology Leadership – Deployment of advanced, continuously improving systems for higher efficiency and lower costs.

-

Proven Track Record – Trusted by large industrial clients and expanding rapidly into consumer markets.

-

Global Presence – Operations in India, UK, China, and Hong Kong, with a diversified portfolio.

Why Wedge Industries Limited is Different

-

70% of revenue from high-performance insulation products with exponential growth EV Battery Insualtion and Cold Chain Insulation industries. Strong supply chain networks in China, India, and Europe.

-

Experienced leadership with proven expertise and more than 22 years leadership experience with largest Industrial companies MCC Group China, CNBM, Microtherm, Promat, Etex Group, ArcelorMittal in industrial materials, global trade, and EPC contracting.

-

Focus on sustainability, energy efficiency, and cost optimization. All structures are backed by transparent agreements, structured repayments, and professional management.

Wedge Industries Limited Growth Sectors

-

EV Battery Insulation – Next-gen fire and thermal protection materials for electric mobility.

-

Smart Insulation Systems – Advanced materials combining aerogel, microporous boards, PIR/PUR panels and traditional solutions for cost efficiency.

-

Energy-Efficient Prefab Buildings – Modular homes, prefab health centers, cold storages, and commercial construction using eco-friendly, high-quality systems.

-

Refractories & High-Temperature Solutions – Engineered linings, castables, and boards for steel, cement, power, and chemical industries.

-

Food & Agriculture – Cold chain packaging, storage systems, and modular facilities for India’s booming agri sector.

How to Become Partner?

We invite strategic investors, venture funds, private equity partners, and HNIs to join us in scaling Wedge Industries Limited.Please fill out the form below to express your interest in investing with us. Our Investor Relations team will review your details and get in touch within 48 hours.

-

Fill and Send formal enquiry form mentioned below to our Investors Relationship team.

-

Our team will connect with you to understand your preferred structure.

-

Receive a detailed investment presentation, ROI model, and agreement draft.

-

Onboard as a valued partner in Wedge India’s growth journey.

Investment Opportunities with Wedge Industries Limited in India

We offer multiple partnership models designed for both investors and financers:

-

Equity Participation in Wedge Industries Limited.

-

Joint Ventures for prefab housing, cold chain, and industrial insulation.

-

Strategic Partnerships in distribution and global expansion.

-

Debt/Convertible Instruments for scaling manufacturing capacity.

1. Equity Participation in Wedge Industries Limited

Investors can acquire equity stakes and become co-owners of Wedge Industries Limited. This provides long-term upside through share value appreciation and dividends. Options include common shares, preferred shares, and structured equity solutions that balance growth with investor protection.

2. Joint Ventures in Prefab Housing, Cold Chain & Industrial Insulation

We invite partners to co-invest in high-growth sectors such as prefab modular housing, cold chain infrastructure, and high-temperature insulation. Joint Ventures allow for risk sharing, rapid market entry, and localized execution, with flexible structures ranging from incorporated JVs to project-specific agreements.

3. Strategic Partnerships in Distribution & Global Expansion

Global and regional investors can collaborate with us to expand distribution networks and market reach. Partnership models include revenue-sharing agreements, co-exclusive distribution rights, and cross-branding deals, enabling fast scalability with reduced capital risk.

4. Venture Debt for Growth without Dilution

An increasingly popular option, venture debt allows investors to fund growth while reducing equity dilution. Typically paired with equity warrants, this provides fixed returns plus potential upside from company growth.

5. Mezzanine Debt for Higher Returns

Mezzanine financing offers high-yield opportunities (often 24–30%) with a mix of debt and equity-like features. It is subordinate to senior debt but ahead of equity, making it a popular choice for investors seeking enhanced returns with calculated risk.

6. Revenue-Based Financing (RBF)

RBF is a flexible, non-dilutive model where repayments are linked to a fixed percentage of revenue. This aligns investor returns directly with business performance and is ideal for scaling manufacturing or distribution operations.

Investor FAQs – Wedge Industries Limited

1. Who can invest in Wedge Industries Limited?

We welcome institutional investors, high-net-worth individuals (HNIs), venture capital firms, private equity funds, and strategic partners with an interest in advanced materials, prefab construction, and sustainable infrastructure.

2. What is the minimum investment required?

The minimum investment depends on the instrument:

-

Equity Participation / Joint Ventures: ₹50 Lakhs (USD $60,000) and above.

-

Debt / Convertible Instruments: ₹25 Lakhs (USD $30,000) and above.

Custom structures for larger investors are available on request.

3. What kind of returns can investors expect?

Returns vary based on the investment option:

-

Equity Participation: Long-term capital appreciation + dividends.

-

Mezzanine / Venture Debt: Fixed returns (typically 20–30% annually).

-

Revenue-Based Financing: Performance-linked payouts as % of revenues.

-

Convertibles: Debt returns with potential upside from equity conversion.

4. How will the funds be utilized?

Investor funds will be deployed towards:

-

Expanding manufacturing capacity in Faridabad & Mumbai.

-

Scaling distribution networks across India & global markets.

-

Strengthening digital platforms (ZJELL.com, Wedge India websites) for B2B e-commerce.

-

R&D in new insulation and prefab technologies.

5. What industries and markets does Wedge Industries serve?

We operate in industrial insulation, EV batteries, cold chain logistics, prefab modular housing, construction, and sustainable energy-efficient solutions. Our products are exported globally, with focus markets in India, UK, Middle East, and South-East Asia.

6. What makes Wedge Industries Limited a strong investment opportunity?

-

Global presence (India, UK, Hong Kong, China).

-

Proven track record with growing 30–40% YoY.

-

Strong manufacturing baes, OEMs, & warehousing base for scaling.

-

High-margin, niche products like Aerogel & Vacuum Insulated Panels.

-

Sustainability-driven portfolio aligned with global green standards.